Tax Officer Olga Stepanova

Olga and Vladlen Stepanov

Name: Olga Stepanova

Position: Head of Moscow Tax Office 28 during 2004-2010

Crime: The authorization in one day, 24 December 2007, of a US$153 million profit tax refund. Olga Stepanova approved the false refund based on forged contracts and fraudulently obtained court decisions without making any appropriate checks required by law

Husband: Vladlen Stepanov (registered a divorce from Olga Stepanova at the end of 2010)

Joint assets purchased since the tax thefts began: US$38 million

Systematic crimes: Between 2006-2008, Olga Stepanova repeatedly authorized fradulent tax refunds. In total US$470 mln (11.2 billion rubles) of fradulent profit tax refunds were organized by the same criminal group, using the same scheme and paid into the same bank (Universal Savings Bank). In April 2011, Moscow Tax Authorities announced that an internal audit identified a further $163 mln (4.4 billion rubles) of Value Added Tax refund that were also illegally authorized by Olga Stepanova in 2010.

Olga Stepanova is a key member of the Klyuev Organized Crime Group. Stepanova systematically authorized fraudulent tax refunds. Her husband wired proceeds to Swiss bank accounts and to purchase luxury property abroad for his wife and for her colleagues at Moscow tax office No 28.

Secret travel with the head of the Kluyev Organized Crime Group:

Immediately after authorizing two huge fraudulent refunds, one for $107 million in 2006 and one for $230 million in 2007, Olga Stepanova and her husband secretly traveled with Dmitry Kluyev, the owner of the bank that received the fraudulent refunds that she had authorized.

In 2006 immediately after authorizing the $107 million fraudulent refund, Olga Stepanova and Vladlen Stepanov joined Klyuev in Dubai and then travelled to Geneva where Mr. Stepanov set up secret corporate bank accounts. They then traveled back to Moscow together on the same flight.

In 2007 immediately before the theft of the Hermitage companies and authorizing the $230 million fraudulent refund, the Stepanovs joined Kluyev in Larnaca, Cyprus, where he was meeting with other members of the Kluyev Orgiinzed Crime Group who were to play key roles in that fraud.

After that fraud the Stepanovs vacationed together in Dubai with Kluyev and lawyers Pavlov and Mayorova, who prepared fictitious court claims used in the tax refund fraud.

The Stepanovs have been compensated extremely well by the Klyuev Organized Crime Group amassing a personal fortune of at least $38 million.

| Officially Declared Annual Income for the Stepanovs (combined salaries) | Assets and cash acquired by the Stepanovs after Olga Stepanova authorized the illegal tax rebates |

| $38,381 | $38,912,000 |

Immediate accomplices: Elena Anisimova and Olga Tsareva, both deputy Heads of Moscow Tax Office No 28. Olga Davydova, Eкаterina Frolova, Olga Tzymai, and Olesya Shargorodskaya – officials of Moscow Tax Office # 28 who signed the fraudulent tax refund requests totalling $153 million (see Approval of Refund signed by Olga Stepanova and her colleagues).

Proceeds of the crime

See below for a list of the assets Stepanov’s family now owns: Real Estate, Offshore companies, Offshore Bank accounts, Travel. Compare it to their declared income.

Real Estate

Land plot

Land plot in Arkhangelskoe Development just off Rublovo-Uspenskoe Shosse, Moscow Region. Registered to Vladlen Stepanov’s pensioner mother.

Location

Coordinates: +55° 46′ 43.27″, +37° 18′ 37.81″

View Larger Map

Ownership documents

These are excerpts from the Centralised Real Estate Registry. They show that a 64,000 sq.f. (5,946 sq. m.) land plot was purchased in the name of Anastasia Stepanova, Mr. Stepanov’s 85 year old pensioner mother whose pension is a few hundred dollars a year. The land was purchased when it was worth millions and is now worth $12,212,000.

Please find all land registration documents on the dedicated page.

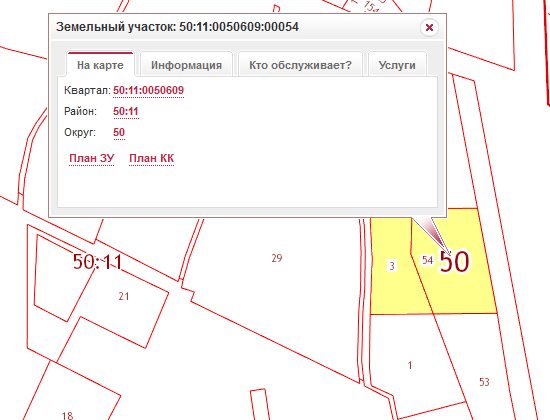

Public cadastral maps:

Please see maps for cadastral number 50:11:0050609:0054 and cadastral number 50:11:0050609:0003

Moscow Country House

Estimated Construction cost: $8,000,000

Market Value with the land: over $20,212,000

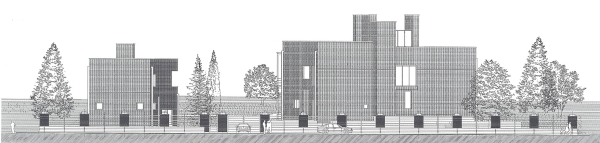

Designed by Alexei Kozyr, Russia’s most expensive architect, and custom built for the Stepanov’s. Winner of the Second Best Country House in Russia.

House: Two houses with total area of 11,840 sq.ft. (1,100 sq.m.) on 64,000 sq. ft. (5,946 sq. m.) of land.

Main house 8,611 sq. ft. (800 sq.m.) with wine cellar, gym, billiards room, sauna, and home cinema, guest house 3,229 sq. f (300 sq.m.) and two car garage.

Address: Arkhangelskoe, Poselok Dachny;

Currently not registered anywhere. It’s clearly visible from space, see Google Maps (+55° 46′ 43.27″, +37° 18′ 37.81″). All of the black colour surrounding the arrow is the roof. The guest house is to the south east and is in the background below.

View Larger Map

Estate in Arkhangelskoe with both houses shown

House in Arkhangelskoe

See more images and drawings of house in Arkhangelskoe

Seaside villa in Bar, Montenegro

Villa in Montenegro

10 down payments were made totalling $471,000. Payments started being made two months after Mrs. Stepanova approved the fraudulent tax refund. It is clear from the bank account number that these payments were in addition to the money in the Stepanovs’ offshore corporate accounts.

The villa now has a market value of $700,000.

[Download this document in PDF]

Dubai Villa

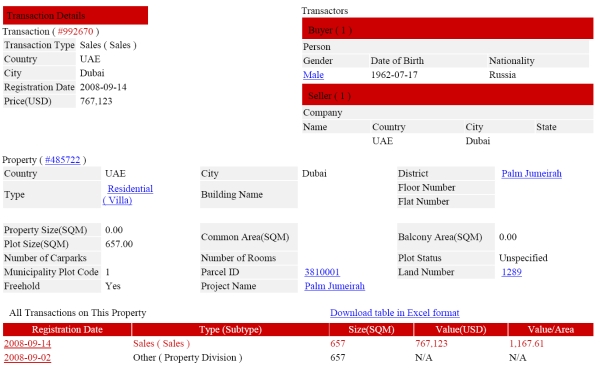

Villa F48 on the Palm Jumeirah, Dubai. Registered to Vladlen Stepanov

Villa on Palm Jumeirah

Villa: An “Atrium Entry Mediterranean “5” bedroom Signature Villa” (The 6th bedroom is for the servant and is therefore not mentioned). Built by Nakheel. http://www.palmjumeirah.ae/property-info.php?developmentId=1&styleId=25.

The villa is 4,900 sq. feet (452 sq.m.) It has 6 bedrooms, 7 bathrooms, 574 sq. feet (53 sq. m.) of balconies and a two car garage. The floors are marble and the woods are mahogany. The villa sits on a land plot with a garden, a swimming pool, and its own beach with a view of the spectacular new Atlantis Resort.

The villa has a market value of at least $3,000,000.

Address: Plam Jumeirah Dubai, Frond F, #48

Purchase Date: 14 September 2008

Vladlen Stepanov stays at the villa with his wife. See records from the Dubai Property Registry:

Excerpt from Dubai Property Registry

Villa Front

Villa back

Villa floorplan

See more photos of villa F48:

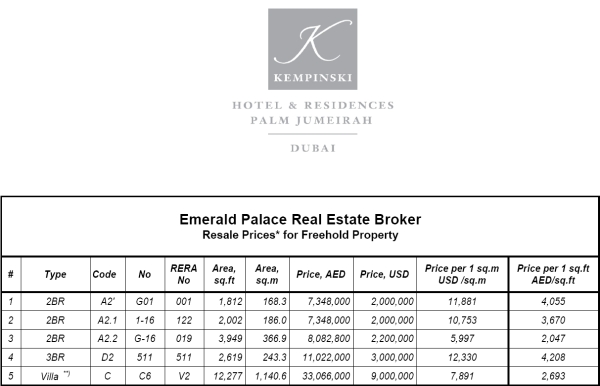

2 Apartments at Keminski Resort Palm Jumeirah, Dubai

Address: Apartments 530 and 428, Kempinski Resort, Plalm Jumeirah, Dubai

Under construction and so not yet registered.

The apartments are each 1,812 sq. feet (183.3 sq. meters) including balconies of 290 sq. feet (26.9 sq. meters). They each have two bedrooms and a living room and 2.5 bathrooms

Purchase Price: $4,000,000 ($2,000,000 each)

Purchase Date: Payments begin in 2007 and continue into 2008

Kempinski Residences Palm Jumeirah

Kempinski Resort and Residences aerial view

Kempinski Residences entrance

Flat Interior

Type A2 floorplan. Each flat is 1,812 sq.feet (183.3 sq.m) including balconies of 290 sq.feet (26.9 sq.m). They each have two bedrooms, a living room, and 2.5 bathrooms

See more photos and floorplans of apartments and the Kempinski Residences:

Kempinski price list showing price of an A2 Apartment

Payment orders for purchase of Apartments 530 and 428

Seven payment orders totaling $2.7 million of the total $4 purchase price of the two apartments. All payments are made in 2007 and 2008. Each payment order clearly indicates that the payment is made on behalf of Vladlen Stepanov. The payment orders indicate the apartment unit numbers and the type from the price list. Each apartment is an “A2” which is a 2 bedroom 3 room apartment that sells for $2,000,000. It is clear from the bank account number that these payments are not being made from the Stepanovs’ offshore companies. In other words, the money used for these payments is in addition to the money in the Stepanov’s offshore corporate accounts. This same bank account was also used to make payments for two more apartments for two of Mrs. Stepanova’s deputies in Moscow Tax office $28.

[Download this document in PDF]

Please check Mrs. Stepanova’s Deputy at Moscow Tax Office, Olga Tsareva’s and Elena Anisimova’s $2 million dollar apartments and the hidden offshore payments made to buy them. All payments were made from the same bank account used to purchase the Stepanov’s two apartments.

Travel Records for Olga and Vladlen Stepanov

Travel records showing that after Mrs. Stepanova approved the fraudulent tax refund the Stepanovs traveled to Dubai 9 times and spent 95 days there. The records also show that they often use Moscow’s VIP departure services, an expensive service which include private check in, a private bar and lounge and expedited customs clearance. A sign at the Sheremetevo VIP private customs post says “We would like to remind highly placed officials that you must still comply with the customs laws of the Russian Federation” least they forget that their positions do not put them above the law. Nothing is written there about compliance with other laws of the Russian Federation.

[Download this document in PDF]

Stepanov’s offshore companies

The two companies hold the equivalent of $11,000,000 in cash.

Arivust Holdings Limited (Cyprus)

Report on Arivust from Cyprus companies Registry showing that the company was set up on 26th January 2008, just one month after Mrs. Stepanova approved the fraudulent refund. Note that the company is not in good standing even though it continues to maintain bank accounts in Credit Suisse, Zurich

Signed letter from Vladlen Stepanov as beneficial owner of Arivurst to the company’s nominee directors agreeing to indemnify them from any and all claims or actions that may arise as a result of providing the Cyprus authorities with the information relating to the Company’s activities during the accounting period ending December 31, 2008. He also agrees to take personal and full responsibility for all the possible legal or tax consequences. He confirms that all information provided to his accountants Paracus Co. Ltd has been recorded correctly by them in the company’s financial statements. It is not known whether the Swiss bank accounts were reflected in those statements and if so, how the source of funds that came to those accounts was explained.

[Download these documents in PDF]

Aikate Properties Inc. (British Virgin Islands)

British Virgin Islands Financial Services Commission Registry report on Aikate Properties Inc. See information of Swiss accounts below.

Letter from Mr. Andrew Moray Stuart, the Sole Director of Aikate Properties Inc. and Maureen Lettsome, Registered Agent of Aikate Properties Inc. confirming that Mr. Vladlen Stepanov is the sole and ultimate beneficial owner of Aikate Properties, Inc.

[Download these documents in PDF]

Stepanov’s offshore corporate accounts

Arivust Holdings Limited (Cyprus)

Accounts in Credit Suisse, Zurich

0835-1300256-72 USD

0835-1300256-72-1 EUR

IBAN USD CH38 0183 5130 0256 7200 0

Statements from a Euro bank account at Credit Suisse, Zurich showing 5 payments totalling EUR7,100,000 (US$11,000,000) being transferred to the accounts of Arivust Holdings Limited. The payments were all made in the period of one month.

[Download these documents in PDF]

Aikate Properties Inc. (British Virgin Islands)

IBC N 1382955

Address: Commonwealth Trust Limited, Drake Chambers, Tortola, British Virgin Islands

Account 0835-1488763-52 in Credit Suisse, Zurich

Statements from Euro and USD bank accounts at Credit Suisse, Zurich showing payments totalling EUR750,000 and US$650,000 (over US$1,600,000 in total) being transferred to the accounts of Aikate Properties, Inc.

[Download these documents in PDF]

Olga Stepanova’s and Vladlen Stepanov’s tax returns for 2006-2009

Olga Stepanova’s and Vladlen Stepanov’s tax return for 2006-2009. They declared an average of annual income of $38,381 combined during the same period when they received the equivalent of $11,000,000 in the Swiss accounts of their two offshore companies and over $27,000,000 in real estate in Dubai, Montenegro and Russia.

[Download this document in PDF]

Complaints Requesting Investigations of the Source of Stepanova’s Sudden Enrichment after the US$230 Million Fraud

To learn more about what happened to Sergei Magnitsky please read below

- Sergei Magnitsky

- Why was Sergei Magnitsky arrested?

- Sergei Magnitsky’s torture and death in prison

- President’s investigation sabotaged and going nowhere

- The corrupt officers attempt to arrest 8 lawyers

- Past crimes committed by the same corrupt officers

- Petitions requesting a real investigation into Magnitsky's death

- Worldwide reaction, calls to punish those responsible for corruption and murder

- Complaints against Lt.Col. Kuznetsov

- Complaints against Major Karpov

- Cover up

- Press about Magnitsky

- Bloggers about Magnitsky

- Corrupt officers:

- Sign petition

- Citizen investigator

- Join Justice for Magnitsky group on Facebook

- Contact us

- Sergei Magnitsky